We make it easy, no matter where you are.

We help you find home financing that fits your needs, whether you’re a first-time homebuyer or refinancing an existing mortgage. We’re here to help you find the best home loan available.

See the latest offers and savings you can recieve from Global Home Finance.

Here’s the secret to how Global Home Finance serves so many homeowners, and why you’ll want to work with us too…

As a Mortgage Broker and Banker, we have access to funds from dozens of wholesale and correspondent mortgage lending entities that we’ve been using for over a decade. This means you can expect superior pricing and the most diverse home loan financing solutions under one roof in a mortgage business.

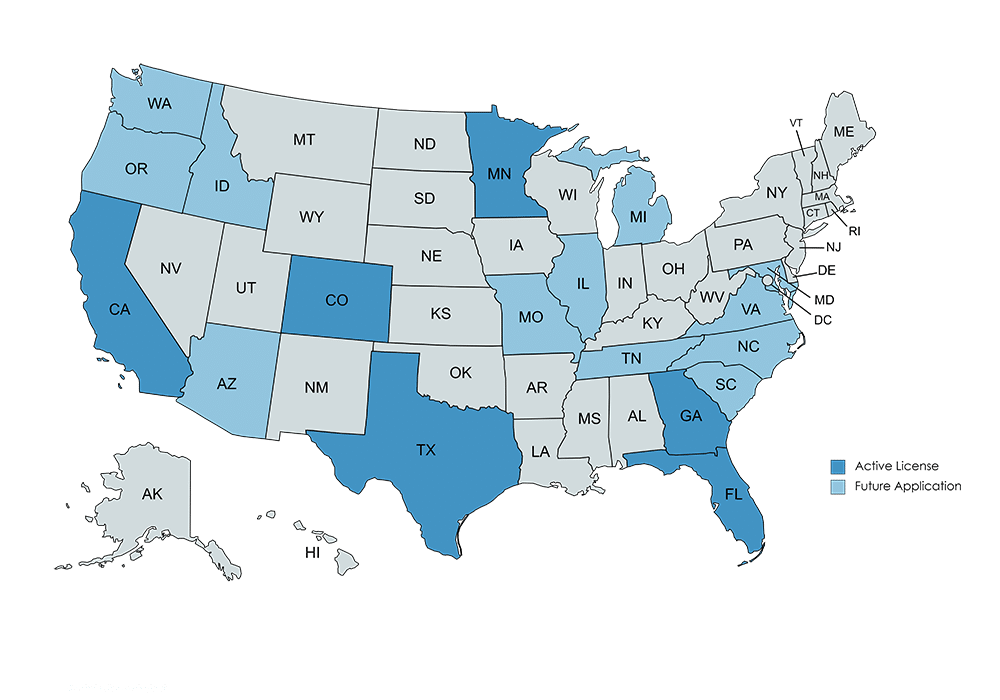

*Additional Assumptions: Pricing is based on a first mortgage loan for those with verifiable income, a 740 middle credit score, $250,000 loan amount, 60% LTV, Primary Residence, Single Family Home or Planned Unit Development, 45% or less total debt to income ratio, No BK/Foreclosure last 7 years. Interest rate is current as of 05/06/2024. Conventional purchase/refinance of Primary Residence. Additional Restrictions may apply. Other options available for less qualified individuals as well Global Home Finance Inc. NMLS #316441 Not applicable to loans locked in processing, closed, or funded. Not valid with any other offer. Global Home Finance is an Equal Housing Lender. Available in Texas, California, Colorado, Florida, Minnesota and Georgia.

There are so many ways to qualify to become a successful homeowner. Let’s find the right home loan for you.

Every month, our Licensed Residential Mortgage Loan Originators help hundreds of homeowners and first-time homebuyers with understanding mortgage financing for often complex and different mortgage companies’ standards. We firmly believe we’re your best bet to find the perfect home loan for your specific needs and qualifications today.

When the banks say no, we say yes!

We originate hundreds of loans every year for homeowners all over the states of Texas, Colorado, Florida, and Georgia. We have established relationships with title companies, builders, realtors, and appraisers. We make it easy to get the best home loan financing. Get in touch with us today!

When you work with a small to medium sized Mortgage Broker and Bank, your licensed Residential Mortgage Loan Originators and Processors will know you by name and will not ask for your loan number to figure out whom to transfer you to. At Global Home Finance, we pledge to work hard for you at a lower cost than our competition and treat you like a friend when you call. Together let’s discover the best home loan for you!

When purchasing your home, there are always new terms to learn or relearn. That’s to be expected. Find out more about mortgage loan solutions from our home finance blog.