5 Dos and Don'ts for Building a New Home

Building a new house is stressful… and with a home construction market as volatile as this one, the process can leave you overwhelmed and out of luck. But when you put your trust into construction loan experts like Global Home Finance, you can also experience the joy and exhilaration that comes with building the home of your dreams.

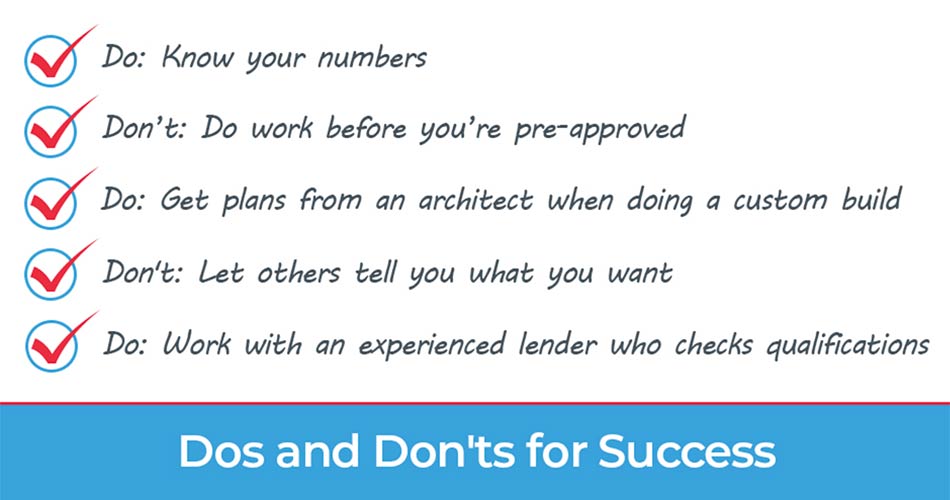

In fact, if you follow these expertly-curated tips from our team, you’ll be ready to roll on your construction project. Here’s what you need to know:

1. Do: Know your numbers. Estimating the project costs is of paramount importance. Using an experienced general contractor or a construction management company to check your work is imperative to create a reasonable budget. Otherwise, you could be short on cash to finish your project—which can be catastrophic. In 2008, many unfinished homes were sold by insolvent individuals and builders. These entities went bankrupt as a result of poor estimating and not having proper funding for their projects.

2. Don’t: Do work before you’re pre-approved. Many people start a project with the best of intentions, but lack the knowledge, discipline, and funds to complete the project. Don’t break ground or do any work on the land besides leveling and grading before you have funds secured. Most lenders will not provide funds mid-construction.

3. Do: Get plans from an architect when doing a custom build. The builders are going to need the architect’s plans to give you a bid. Most home plans will cost around $2,000–$3,000 for a semi-custom or fully-custom set of architect’s plans. Standard plans are available online for much less and can be used for standard builder-grade homes. Know what you want before you go to an architect. You can even bring rough sketches to show them!

4. Don’t: Let others tell you what you need. The people you’re dealing with will likely make suggestions. While good advice is valuable, you are the one who has the final say. You need to decide what you need. This is your house—so make it comfortable, functional, and a place you want to stay without bankrupting the budget. Remember, it can also be a healthy investment that yields lots of financial appreciation and fond memories.

5. Do: Work with a lender who checks out your general contractor’s qualifications. In Texas, it isn’t a requirement to be licensed as a general contractor. The barrier for entry is so low it often attracts some bad actors. Having a lender vet your general contractor by checking their credit for tax liens, judgements, and UCC filings is essential. Working with a lender who has construction management staff will protect both your project and your money.